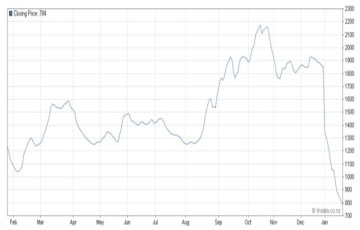

An opportunity to buy or a danger sign? ETF Securities reports that global gold exchange-traded products such as the SPDR Gold Trust (GLD) suffered their largest outflows in three months last week. As that was happening, net speculative long positions in the futures market fell near April 2009 lows.

With gold futures down 1.7% to $1657 an ounce recently, the market is a-chatter about the strong dollar and the outlook for interest rates, though an Indian jeweller strike and weak data from China have also played roles. Traders are taking little consolation from Goldman Sachs’(GS) bullish view this morning, which repeated the bank’s call for gold to reach $1,840 in six months and $1,940 in a year.

Like Goldman, ETF Securities seems confident that the metal will keep its pace:

ƒ Global gold ETPs see largest outflows in 3 months as gold price fall shakes out short-term investors. Sustained gold price weakness and a pull-back in broader risk positions caused ETP investors to pare back gold holdings last week. Total global outflows amounted to around 0.7mn ounces or around $1.1bn at the current gold price. This compares to total gold inflows of around 1.7mn ounces ($2.9bn at current gold price) up until the previous week. The gold ETP selling coincides with a further large-scale clearing of speculative futures market positions, with the latest CFTC data (data to March 20) showing that net speculative longs in the futures market have dropped back down towards April 2009 lows (see positioning charts on page 4). The gold price decline and investor selling has been sparked by upward revisions to the US rate outlook (and related US dollar strength) as US economic growth has continued to improve. It appears that shorter-term investors, recognizing the near-term headwinds to further gold price gains resulting from current improving US growth prospects, are trimming positions. However, with real interest rates expected to remain structurally low in most reserve currency countries, sovereign debt and financial system risks still high and structural demand from emerging markets and central banks still in their early stages, it is unlikely the recent price declines will shake out longer-term gold ETP investors. With net long speculative positions now near April 2009 lows, a firmer base has been set for future long-term price gains.

Some key points from the Goldman report:

Gold prices remain too low relative to the current level of real ratesUnder our gold framework, US real interest rates are the primary driver of US$-denominated gold prices. However, after being remarkably strong in the first half of 2011, this relationship broke down last fall, with gold prices falling sharply in the face of declining US real rates, as tracked by 10-year TIPS yields. While gold prices have returned to trading with a strong inverse correlation to US real rates since late December, at sub-$1,700/toz they remain below the level implied by the current 10-year TIPS yields. The gold market’s expectation that real rates would be rising along with economic growth may help explain this valuation gap We believe that despite last fall’s decline in 10-year TIPS yields, the gold market may have been expecting that real rates would soon be rising along with better economic growth, leading to a sharp decline in net speculative length in gold futures. Accordingly, a simple benchmarking of real rates to US consensus growth expectations suggested a level of +40 bp by year end. Our models suggest this higher level of real rates would be consistent with the current trading range of gold prices. As we look forward, our US economists expect subdued growth and further easing by the Fed in 2012, which should push the market’s expectations of real rates back down near 0 bp and gold prices back to our 6-mo forecast of $1,840/toz.Subdued US growth in 2012 will likely support gold prices, although risks to our constructive view are rising We reiterate our constructive outlook for gold prices in 2012 and our 3, 6-and 12-mo forecasts of $1,785/toz, $1,840/toz and $1,940/toz, respectively. We acknowledge, however, that continued strong US economic data poses growing risk to our forecast for rising gold prices. Net, we reiterate our view that at current price levels gold remains a compelling trade but not a long-term investment, and we continue to recommend a long position in Dec-12 COMEX gold futures.